“How We Got Here” is the first part of a three part series on the global financial reset. We will go back to the beginning when our system was put in place and what it means moving forward, how it will affect you, and what you need to be doing about it.

An ugly look into the our financial past.

“Inflation is transitory!”

“Rates won’t go up for years!”

The powerful elites running our country did everything they could to avoid what was inevitable, admitting we are in a recession.

Even those that are apolitical or surface level followers of the economy could see through the lies, but even the most ardent followers may not be aware of what is in store next and it may be the biggest overhaul to our economy since 1971.

The White House and America’s biggest institutions such as MasterCard, Chase, Bank of America, WellsFargo, Citi, Bill Gates, the Clinton Foundation, and the World Economic Forum are preparing for this overhaul.

The way we spend, borrow, and invest could be upended in unthinkable ways and Bank of America has already said this change is inevitable.

The Federal Reserve is writing the rules as we speak and if successful it will have millions of people forced into its newfound system.

You are at risk.

This could be the biggest financial disaster since the Great Depression and if you have a U.S. bank account or retirement plan, you better pay close attention.

Escape what social media and mainstream media feed you and you could be prepared, and escape America’s darkest hour with your personal and family wealth intact.

The government has a history of using fear, emergencies, and even lies about its temporary nature as a means to shove their goals past the finish line. It is why we still take our shoes off at the airport despite no data or rational reason to do so.

Every single American with a savings account, in a retirement plan, or even folks who simply collect fixed income will be affected. Fear will be the catalyst to your vulnerability.

You will hear about the ‘new normal’ just as you did during the pandemic. Do not fall for the manipulation because we could see money as we know it disappear in the very near future.

Some of you might have started to notice that many businesses have stopped accepting cash. Many claimed it as a health precaution during the pandemic yet these businesses never went back to accepting it.

This was a test to see if Americans would willingly accept a switch from cash to a digital dollar. It also allowed for businesses to put the infrastructure in place for the inevitable shift to a cashless society without raising too much suspicion. Visa, Chase, and our banking industry are already building this out - the plan is in motion.

It is important to understand that financial resets have happened before, three times to be exact. In 1907 in reaction to a financial panic, powerful brokers like J.P. Morgan and others united to “save the financial system” by planning a centralized banking system.

In reality, the elite used fear to institute one of the most infamous power grabs in history. Ordinary citizens lost 96% of their wealth. I am talking about the Federal Reserve Act which was signed in 1913 and formed America’s central bank.

Nearly every atrocity for the century that followed can be attributed to this moment in history and compounded by a few key dates later on.

First, we need to distinguish between money and currency. Money is a store of value, meaning it holds its value over time. Currency is NOT a store of value and loses its value over time. Today, our currency is referred to as “fiat money,” and the word fiat means “let it be done.”

This answers the question, if our currency holds no value, then why is it used? The simple answer is the government tells us it is valuable so use it…let it be done.

Today we are not paid for our labor with money, we are paid in currency. We are paid dollars that lose their value every day, in a system that can print these dollars without our consent, causing us to pay more for the things we need - or simply known as inflation. Inflation is simply a hidden tax on its citizens.

How did we get here?

Back to the story and how we went from a nation of money to a nation of currency.

After the Federal Reserve Act, the second financial shock happened during the Great Depression at the hands of our president at the time, Franklin Delano Roosevelt. The stock market had plummeted 89%, unemployment soared, and more than 1,300 banks had failed.

As confidence in the financial system cratered, President Roosevelt “came to the rescue” just as J.P. Morgan did a few decades prior and used the crisis to advantage the elites. The legislation FDR signed into law was called the Emergency Banking Act which actually shut down the Federal Reserve for four days as well as gave the President new powers.

At the time, in 1933, our dollars were backed by gold. FDR decided to use his new powers to sign Executive Order #6102, which forced Americans to turn in their gold savings.

The government gave each citizen $20.67 for every one ounce of gold they turned in. Since the dollars were backed by gold, the citizens were under the impression that they could simply turn in their dollars for gold at any point.

Once the government had everyone’s gold, Roosevelt, with his new powers from EO #6102, revalued the price of gold to $35 an ounce. This EO stole 41 cents on the dollar from every American citizen.

For example, if you turned in 100 ounces of gold at $20.67/oz, you would have received $2,067, but with a flick of the pen, the government owns your 100 ounces now valued at $3,500. Extrapolate this amongst the millions of people turning in their gold and at the time this was the largest theft of the people in history.

The people lost 41% of their wealth by trusting the government in a time of crisis. This is a story that gets repeated over and over and still exists today.

You may ask yourself, “why would the people go along with this?”

When the government wants something badly enough, they will get what they want by any means necessary. Anyone that didn’t comply with FDR’s gold theft was punishable with a $10,000 fine and jail time. That fine today, adjusting for inflation (oh the irony), is $236,173.

The government said people weren’t “forced” to turn in their gold - technically true, but if they didn’t want their lives destroyed they turned in their gold. At a minimum it is coercion, but I call it pure Governmental brute force.

This is a similar pattern that has happened many times in history and it is happening again today. Our government will never let a good crisis go to waste and the next money grab was a little over 37 years later.

In 1971, America was in the midst of the Vietnam War, and President Nixon interrupted the weekly episode of Bonanza to address the nation with the shocking announcement that the dollar was to be temporarily decoupled from gold.

What exactly does that mean?

The paper dollars backed by actual gold bullion were held on deposit at Fort Knox and at the New York Fed. Nixon’s decision completely removed the gold value that made our dollars worth something. Today they are backed by nothing but the population's trust in that dollar through government coercion. When that trust is gone, our dollar is gone.

Today, how much trust do we have in our dollars? What about our government and their use of our dollars? This should scare you.

At the time of this decision, our government was spending more money than we had on social programs like the Great Society and our unnecessary war in Vietnam. The problem for the government and the Fed is that we were spending more money than gold in the vault. Instead of cutting spending, they decided to remove our dollar from the gold standard.

Since that day, if the government wants to spend more, they just fire up the printing machine and print more money. There is nothing backing it, so no accountability for the amount of money in the supply and we all know, the larger the supply, the less value it will have.

Every time we print more money, the dollar loses value or purchasing power. Purchasing power is simply the amount of goods and services one can buy with a unit of currency.

The average car in 1971 took about 20 weeks of work to pay for it. Today, the average car will cost you about a year's salary to afford it. Our purchasing power was destroyed.

In nearly 60 years, we went from owning a tangible commodity such as gold, to dollars backed by gold, to a fiat currency that is worthless. This is where we sit today, a government that spends our hard earned dollars with reckless abandon to the tune of a 33 trillion dollar debt and on the precipice of an economic collapse that will end an empire.

But they have a plan! Just like every crisis before, there is a plan, an evil plan…but before discussing the plan, back to the story.

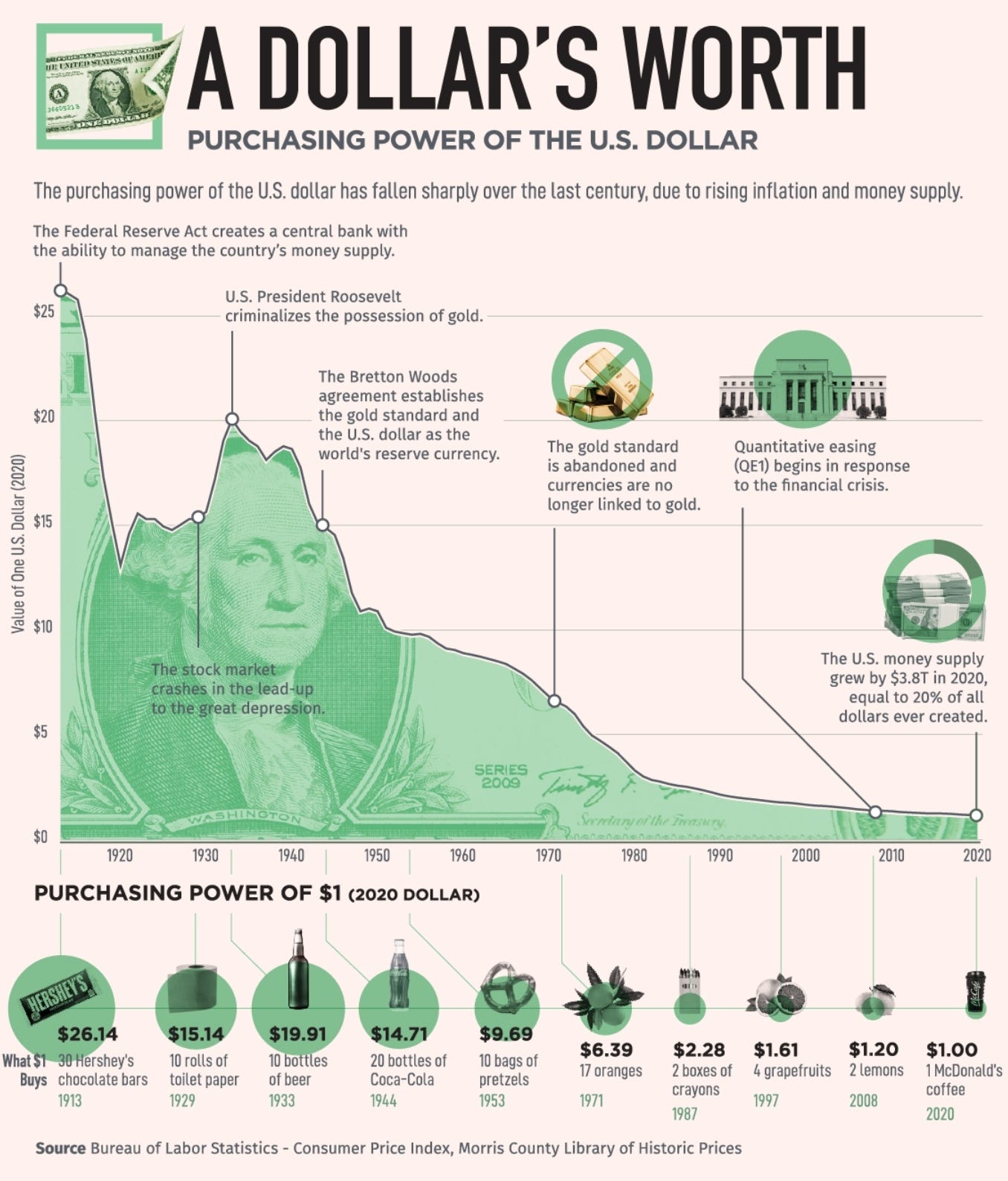

Our problems are simple supply and demand. The more something exists in the world, the less it’s worth. Take a look at this chart, our purchasing power has declined 96% since the creation of the Federal Reserve.

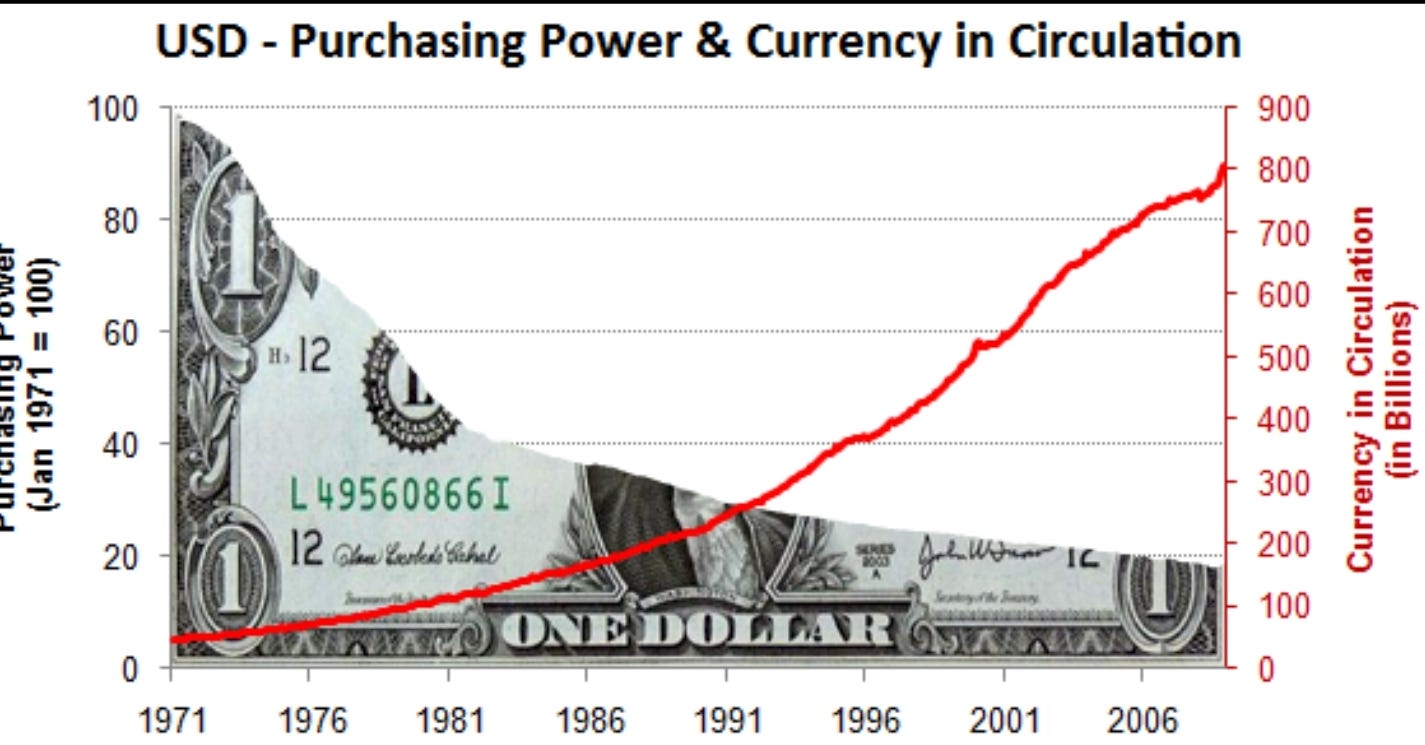

Now let’s take a look at this decline in purchasing power relative to our constant injection of currency into the circulating supply. It is very clear. The more you print, the more your dollars decrease in value.

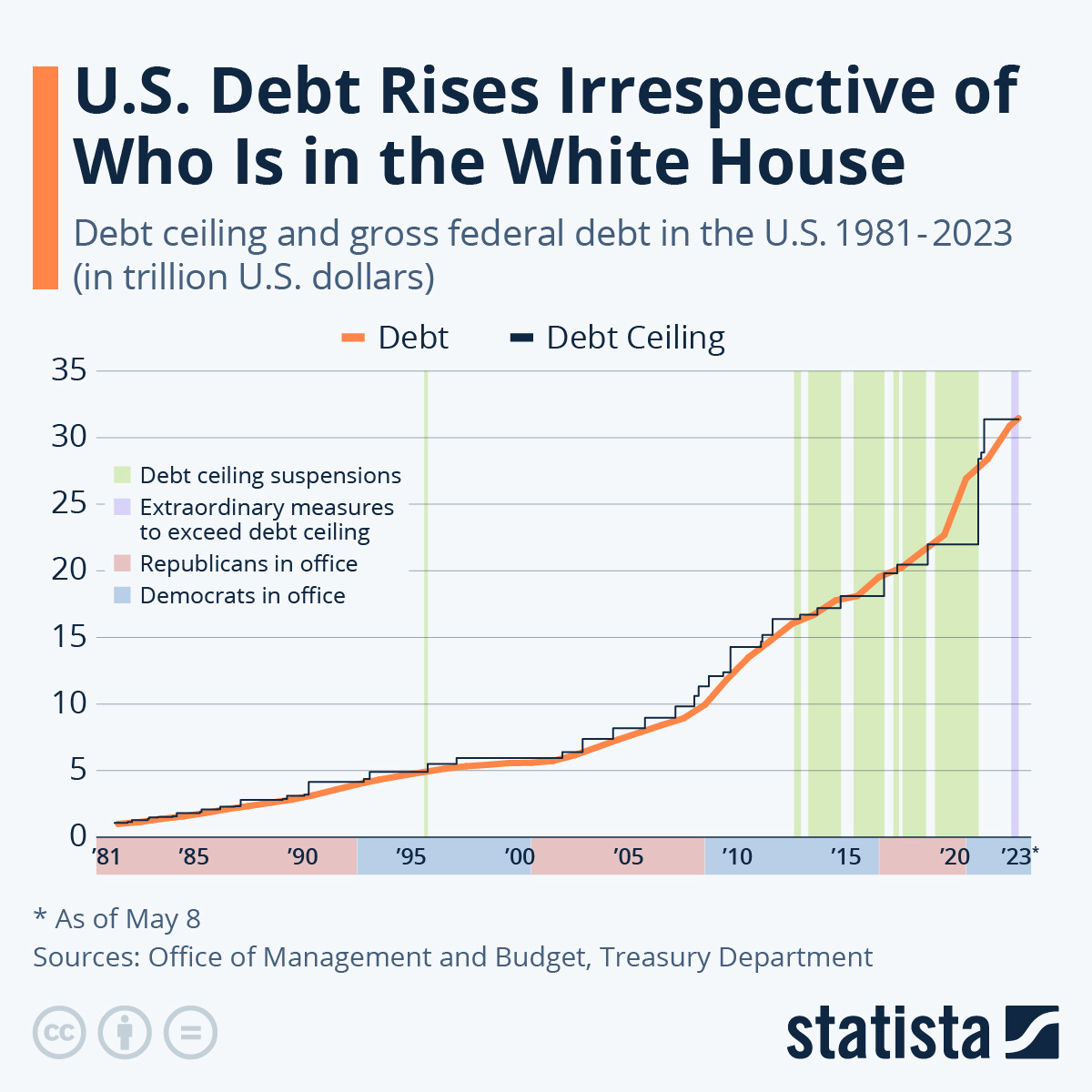

Now take a look at the rise in our debt.

In 2019 our federal debt was 23 trillion dollars, in just a few years it is up to 33 trillion dollars. That is a 44% increase in debt in only 4 years. It will never be paid back, so there will need to be a plan.

If you think this plan will be partisan, think again. As the chart shows, our money printing is abused on both sides of the political aisle.

Before 1971 most families were single income, with no debt, a house, a car, and kids. The 1970’s birthed the dual-income household in order to pay the bills due to inflation, inflation caused by the new fiat currency.

The 1980’s and 1990’s was the start of families leveraging debt and borrowing their way from paycheck to paycheck. Fast forward to today, where most Americans need to take out a 30 year loan on a house or a 5 year loan on a car in order to have a roof over their head and the ability to drive to work.

This system started by the creation of the Federal Reserve and accelerated after Nixon took the dollar off the gold standard. Over the years, every last bit of value has been stripped from our money. First, it was gold, then it was paper, and now, the last physical dollar could soon be printed and our money could disappear altogether and replaced by a new type of dollar that will permanently change the function of our money from a simple medium of exchange to an Orwellian technology that many won’t understand at first…and that is the trap.

This plan will be disguised by the crises and spun as a way to “protect” Americans, just as every plan with an ulterior motive in the past has been stated. It is a coup by the powerful elite.

If you look back at the three big economic moments we discussed, The Federal Reserve Act, Roosevelt’s gold confiscation, and the removal of the gold standard, have all resulted in more power and control for the government and less wealth for Americans like you and me.

Next up, Part II - “The Tyrannical Puzzle Pieces”

In Part II, we will examine the lengths world governments are going in order to reset the financial system, what you need to look for, and ultimately what you can do about it.

If you enjoy this content and don’t want to miss Part II of this series, please make sure to click the subscribe button for more free content.

Make sure to follow NoNationNews on X