What is a CBDC? It stands for a Central Bank Digital Currency and to put it simply, it is programmable money controlled by the central bank and government.

For a more in depth discussion on CBDC’s please read our previous article CBDC's - The End of Freedom? as well as Digital ID or Digital Prison? because it is imperative to understand that Digital ID will be a lynchpin in carrying out this system.

Two Different CBDC Systems?

Many of you are aware of CBDC’s but most don’t realize that there are technically two types of CBDC’s. Retail CBDC’s which will be used by the average person and wholesale CBDC’s which will be used by select individuals and institutions.

One system for the elites and another for us, the lowly average citizen.

Nearly all coverage of CBDC’s has been on the authoritarian nature of the retail system, and it is justified, but very little attention has been paid to the wholesale system, its qualities, and the plans to launch it parallel to the retail system.

The Bank for International Settlements (BIS), which is basically the bank of central banks, is building both systems. This is scary. If pulled off, our money will be on one system controlled by the elites that operate on a completely different system that allows them freedoms that we will not be given.

The BIS is working diligently on the interoperability of CBDC’s between countries. As Larry Fink said, “We are here to tokenize the world.”

What is mBridge?

The BIS is in charge of a project called mBridge which stands for Multiple (CBDC) Bridge. This is the result of a collaboration between two wholesale CBDC projects, Lion Rock by the Hong Kong Monetary Authority and Infeneon by the Central Bank of Thailand.

In January 2020, these two central banks created a cross country wholesale CBDC prototype.

In February 2021, the BIS, the Central Bank of China and the Central Bank of the UAE came on board to this project.

The cross country CBDC project then completed a proof of concept test in September 2021.

Here is where the red flags start to appear. Consensus, one of the largest companies working on Ethereum, was chosen to develop the mBridge proof of concept.

In September 2022, the central banks of Hong Kong, China, the UAE, and Thailand completed the successful pilot of mBridge. Over the course of six weeks the mBridge platform was stress tested, performing real value transactions among 20 commercial banks from four different countries around the world.

It took one full year for the US to realize what was going on, that the existing financial system was completely bypassed.

An article from Bloomberg in 2023 stated:

“The Beijing backed digital prototype for sending money around the world without relying on US banks is advancing so quickly that some European and American observers now view it as an emerging challenger to dollar denominated payments in global finance.”

Bloomberg also stated that the MVP mBridge would be ready by the end of 2023. MVP means minimum viable product. It is basically an initial public release and it marks the closest to an active CBDC that we have witnessed thus far.

The BIS states that it will be officially launched in early 2024 but there is little clarification on whether the MVP mBridge has launched or if it is soon to arrive. With that said, A few weeks ago the UAE conducted its first transfer on mBridge, suggesting that the MVP is now live.

Either way, this is too close for comfort.

In October 2023, the BIS gave an update on mBridge. It contained detailed information on what to expect from the MVP.

“The payment system underpinning cross border financial flows has not kept pace with rapid growth in global economic integration. Logically, this means a new one is needed.”

“Banks are also pairing back their correspondent networks and services, leaving many participants, notably developing economies, without sufficient or affordable access to the global financial system.”

There is really no other way to interpret this, the BIS and the central banks around the world don’t like our existing financial system because it is increasingly weaponized against individuals and institutions in the global south. This makes sense considering the US and its allies are increasingly using it as a weapon.

The BIS was also quoted as saying:

“Project mBridge experiments with a multiple central bank digital currency common platform for wholesale cross border payments to solve some of the key inefficiencies of cross border payments, such as high costs, low speed and transparency, and operational complexities. At the same time, the project aims to safeguard currency sovereignty and monetary and financial stability for each participating jurisdiction.”

A new financial system is being created before our eyes.

How exactly does mBridge work though? I have provided a document from the BIS’s October update that explains in detail, but we will summarize below.

BIS Document Detailing mBridge Project - please go through this document, it is the mBridge playbook.

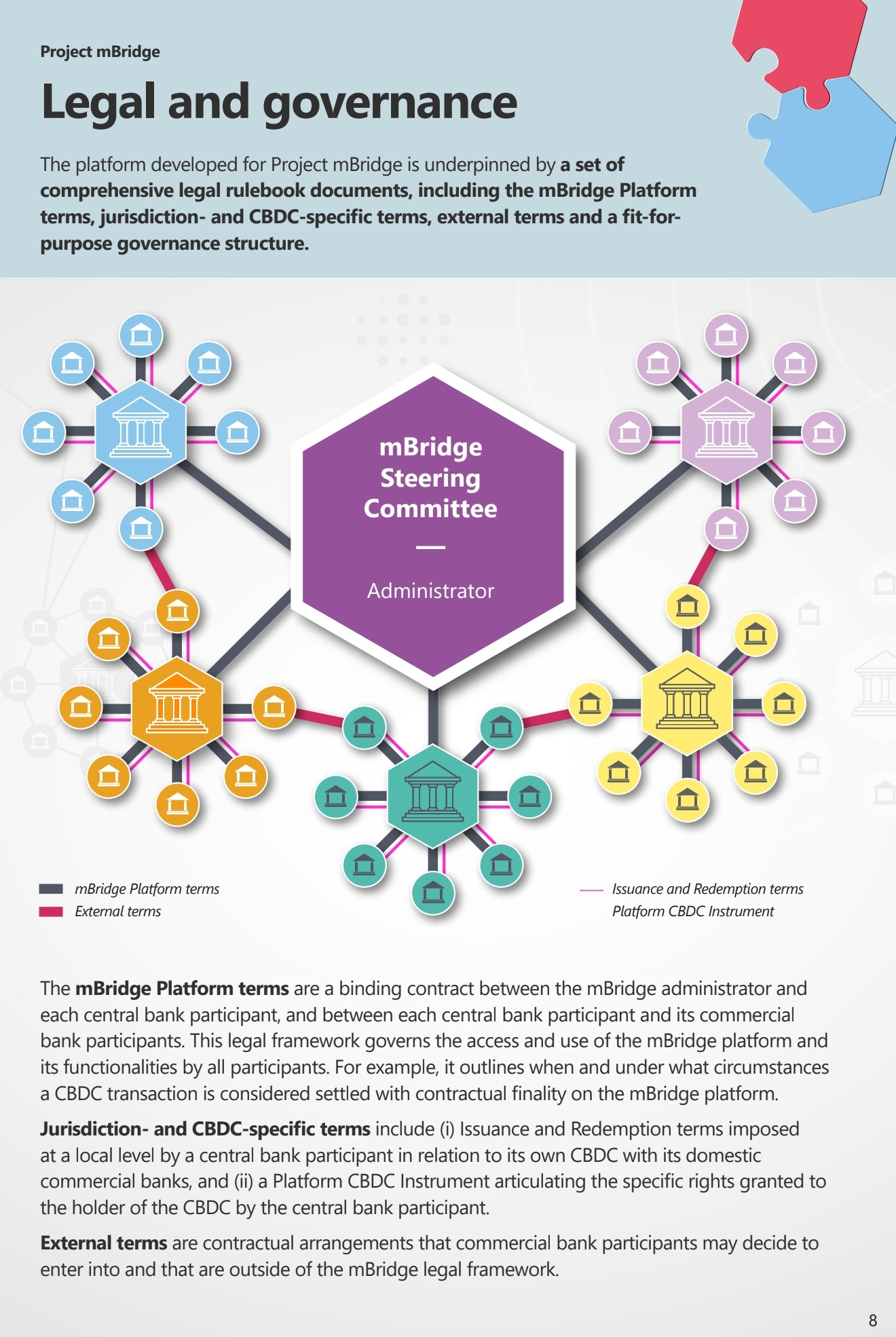

As with retail CBDC’s, central banks will have total control over their wholesale CBDC’s. Specifically, the document notes that only central banks will be able to issue and redeem wholesale CBDC’s and that central banks will have the power to set limits on how much wholesale CBDC their commercial banks can hold. Each central bank has a full audit trail and transparency of its CBDC’s transactions.

This confirms our “conspiratorial” thoughts on this all along, that this system will not allow for privacy. Central bankers from around the world will lie to you and tell you otherwise. This document, however, reveals exactly what mBridge is working on.

“Commercial banks often lack direct relationships with offshore counterparties and must rely on a global network of correspondent banks to make cross border transactions. A typical cross border transaction would involve not only the payers and payees to local banks, but also their correspondent banks, which may be offshore.”

Fun fact, most central banks are owned by commercial banks. Knowing this, I read the above and it is clear that the goal isn’t to get rid of all the commercial banks, just some of them, the ones that aren’t in control of the central banks.

mBridge is a permissioned distributed ledger or a permissioned blockchain called mBL. mBL is an EVM-compatible solution, referring to the ability of a blockchain to process transactions based on smart-contract codes that can run on widely used blockchain platforms.

“CBDC issuance, redemption, and payments are implemented through smart contracts written using the Solidity programming language. The code is shared and open sourced among the participating central banks.”

mBL is a permissioned version of Ethereum. The difference is Ethereum uses proof of stake as its consensus mechanism, mBL uses a novel technology called dashing consensus, which “uses proofs of partial confirmation of a block validation to reduce the time needed to achieve consensus and to improve the overall protocol performance.”

Dashing consensus was developed by a partnership between the People’s Bank of China and Tsinghua University, which is the alma mater of Xi Jingping.

One would connect these dots and believe that it is China driving the mBridge project. I would believe this to be correct.

mBL is also ISO 20022 compliant. ISO 20022 is a messaging standard that’s being used not only by CBDC’s, but also fast payment systems, which are the precursors to CBDC. This describes the Fed’s Fed Now programs that we discussed in our previous article on CBDC’s.

For more information on ISO 20022

Who Controls The System?

This leads to the last piece of the puzzle, governance, or control of the mBL.

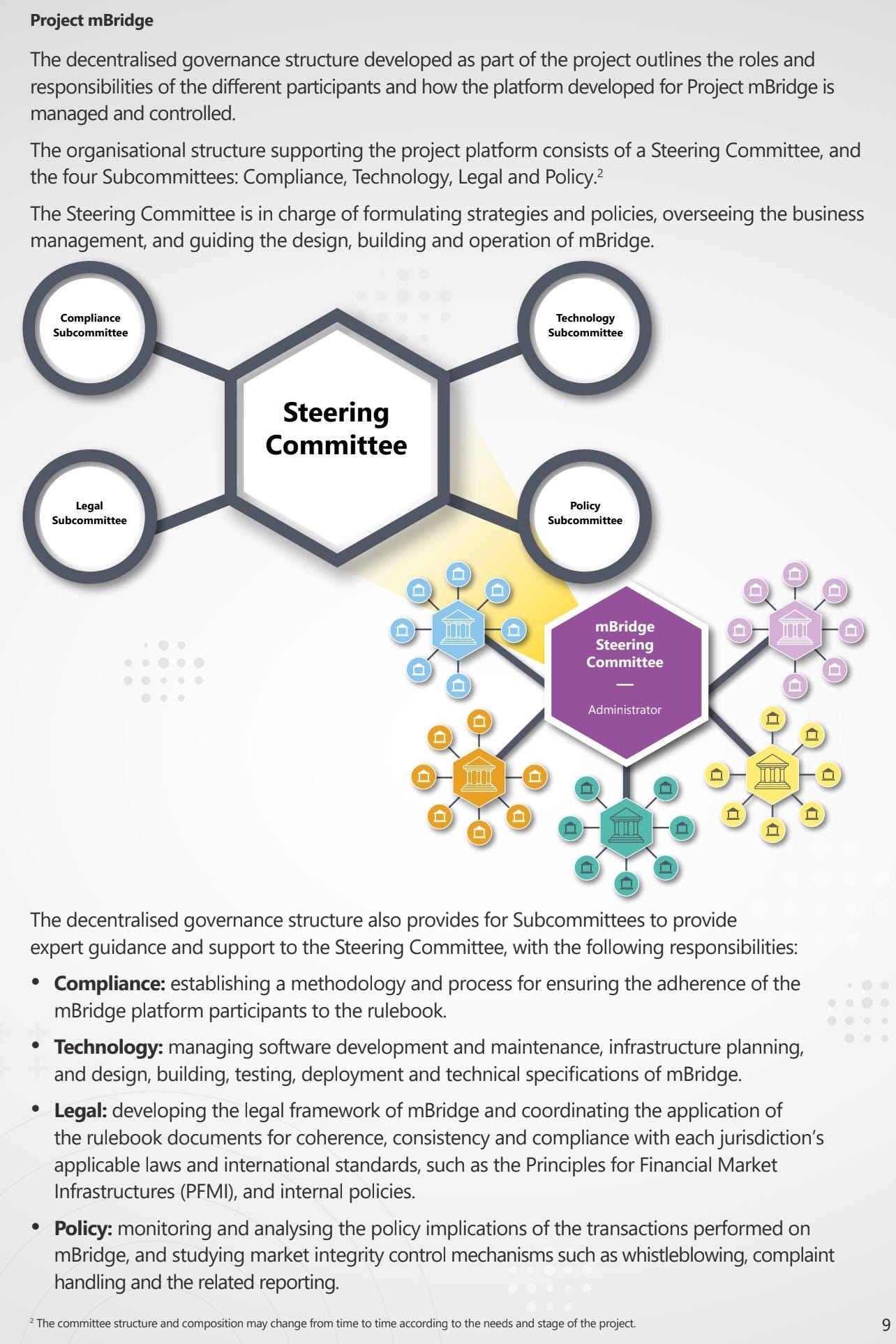

The Steering Committee is in charge of formulating strategies and policies, overseeing the business management and guiding the design, building, and operation of mBridge.

Eerily enough, there isn’t any information regarding who is on the Steering Committee.

What we know is that the Steering Committee will be advised by four subcommittees: compliance, technology, legality, and policy. It looks like central banks from around the world will be governing this system and subcommittees. Scary.

The literature will often times use language such as, “decentralized.” There is nothing decentralized about anonymous entities within committees and subcommittees, that are most likely central banks, with control over a monetary reset determining your financial freedom.

We are getting closer and closer to the global CBDC system. One where every asset you own is digitized and tokenized on a blockchain that central banks and governments control, giving them the ability to decide your ownership of these assets based solely on your alignment with their ideology.

The fact that mBL is based on Ethereum means that it becomes possible to innovate rapidly. It becomes a copy paste system.

One thing to note, as mBridge becomes more powerful, the desire to control it will increase. This would lead to governance disputes which could lead to forks in mBL. This is no different than past disputes resulting in the forking of Ethereum and other crypto blockchains.

This forking leads to fragmentation which will make the two resulting systems less powerful, opening the door to competition. mBridge isn’t the only cross country CBDC project; competition is looming.

Could this lead to the weakening of the CBDC system?

What if mBridge fails and the central banks switch to using Ethereum or even a layer 2 solution? If this were to happen the desire to control Ethereum would dramatically increase.

Ethereum is proof of stake, all that is required to do this would be to buy up enough ETH to control the blockchain. I see this as a possible play for the US, as they have the strongest currency.

This would create a supply shock of ETH, intensely driving the price upwards while simultaneously completely centralizing it in the future.

Could this be the purpose of crypto ETF’s? Short term euphoria traded for long term centralization? We need to pay very close attention to the next round of ETF announcements which will surely be based around Ethereum.

One thing we know for certain is that as the mBridge MVP roadmap starts to achieve its goals, the US and its allies will not be happy about it. This could lead to further geopolitical escalation, resulting in more conflicts as well as trade restrictions.

Buckle up. I believe we are in for a wild ride.

Make sure to follow NoNationNews on X