If you haven’t read the first two parts, please check them out here:

Draconian, Tyrannical, Orwellian, Enslavement, you choose your description.

Pelosi’s Take Responsibility For Workers and Families bill (discussed in Part II) authorizes the Federal Reserve to record and track all transactions involving digital federal reserve notes. In other words, a new digital dollar combined with the removal of physical cash would mean the end of our financial privacy. It would also mean the end of freedom and liberty in America.

Imagine if all your new “digital money” is stored in an account managed and tracked by decision makers at the Federal Reserve. They will know everywhere we spend our money and everything we buy, and it will also hand them total control over every part of our lives.

Surveillance and control, I don’t want any part of that. Do you?

Some will argue, “if you aren’t doing anything wrong, what does it matter?”

Anyone that attempts to be a student of history will easily see how they’ll use this against ordinary Americans. We don’t have to go that far back to see how the Canadian truckers had their bank accounts frozen during their protests in 2022.

When they control the money, they will have the power of social control. It will be a nanny state. You will have to ask daddy government for your allowance to buy hamburger meat, while your overlords can deny the transaction because you have exceeded your monthly limit of red meat.

Again, you don’t have to be a criminal or have ill intentions for this to negatively impact your life.

They could suspend your driver’s license because your inspection sticker expired yesterday.

They can deny your purchase of a plane ticket because you refused their latest “health” mandate or because you have used “too much carbon” this month.

What’s to stop them from locking you out of your bank and retirement accounts entirely?

China already does this. Their social credit score system is what America is adopting. Totalitarian powers that enslave its people is what is in store.

They will again use language like, “during times of crisis or emergency, we want the ability to add stimulus directly to your account. During covid, the process of Americans getting their stimulus was slow and inefficient. We aim to change that.”

Just remember, if they can add money to your account, they can reach in and take money from your account as well.

They could force you to “share” your retirement savings in the name of “fairness and equity.”

Trillions have been added to the Fed’s balance sheet, and with the turmoil in the banking system, it appears that bills are now coming due.

I believe the most successful, high earners, with large accounts, could become the Fed’s first target.

With the digital dollar in place, the Fed could deploy a “penalty” to people who keep a balance to “stimulate spending.” What if this penalty is 5% on your deposits. Imagine opening up your bank statement and watching your savings shrink every month!

Imagine collecting your paycheck and being told to spend it now or it will expire next week.

This technology is already being discussed by the World Bank and tested overseas.

Most of the time when someone thinks about an upcoming crisis they can’t help but think about the previous crisis. A real estate crash, a stock market collapse, but the next crisis will look much differently.

The big question, what can we do?

First, none of this is financial advice. I will simply explain my strategies. As always, you need to do your own research, and figure out your own plan. While reading this three part series, you have come across enough information to get you into motion and be proactive against what is coming. Time to turn it into action.

During FDR’s gold confiscation there weren’t off ramps available to protect one’s wealth. Fortunately, we have evolved to a point today in which we have a few options to protect ourselves.

The big three are Bitcoin, Gold, and Silver. I will go into each commodity but understand that each has their pros and cons.

None of these commodities are a surprise safe haven, nor is it groundbreaking information. That is fine, I am not selling anything or claiming to have a secret formula. However, it is important to understand why these commodities can help you fight what is coming.

Gold

First, the Biblical take on gold is important to discuss, regardless of your beliefs.

“By your wisdom and your understanding you have made wealth for yourself, and have

gathered gold and silver into your treasuries…”

Ezekiel 28:4

The Bible mentions gold 417 times and silver 320 times and says that it is God’s money. This is important because some of our first documentation of human commerce makes it very clear that gold and silver are a precious store of wealth.

Today, gold remains one of the most effective stores of wealth.

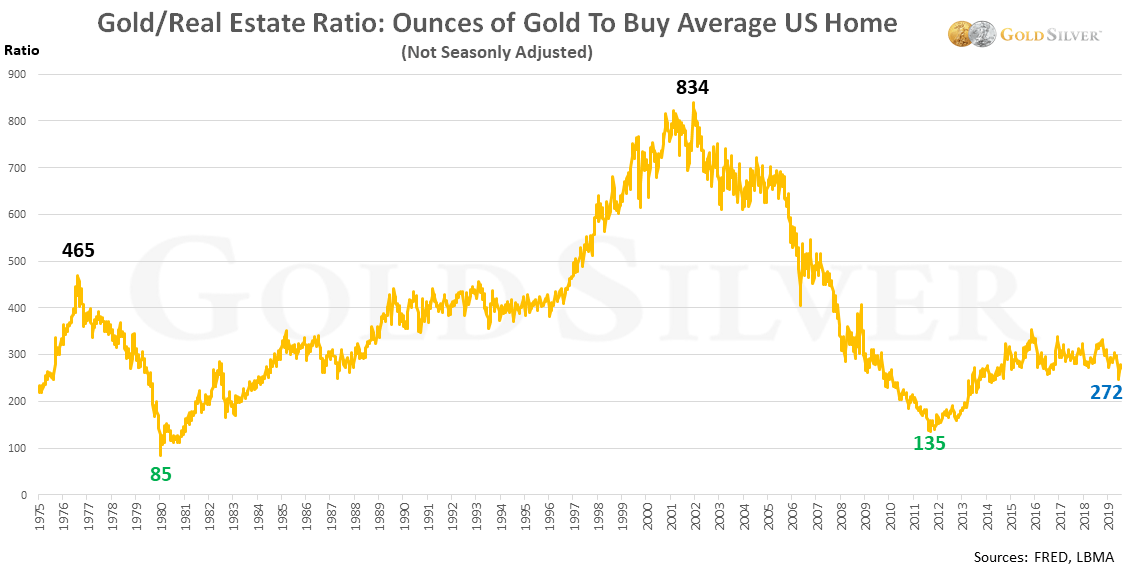

When looking at the above chart, you can see what its price action is in moments of crisis, inflation, and market woes. As you can see, when facing market pressures, inflation, or a housing crisis - gold holds its value.

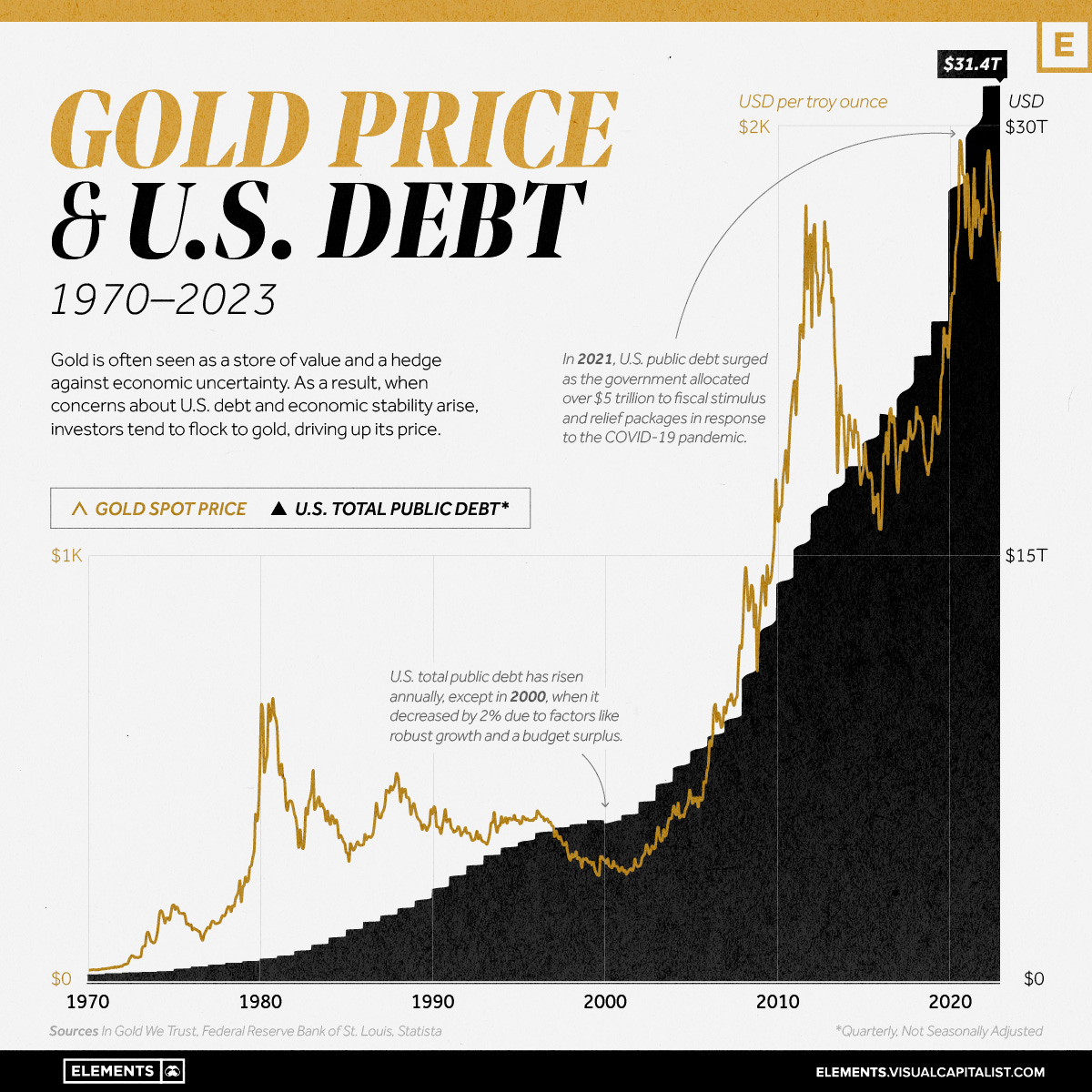

As our debt increases, the value of gold rises with it, preserving your wealth. Our debt is a runaway train, destined to increase dramatically and more intensely each year. What does that mean for the price of gold?

Gold may seem like a slower horse when compared to other commodities and investments, but when the system collapses, Gold has historically been king.

To recap, gold is a safe, slow, and steady commodity that does an excellent job in holding your wealth value over time against a depreciating and dying dollar…with a chance that its price skyrockets in the scary, yet probable event that our entire financial system craters.

It is probably the safest haven for your wealth that exists.

I can only think of one possible negative to owning gold. One complaint I hear is that it isn’t easily transported, because it is physical. While I agree this is one major edge bitcoin has on it, I don’t necessarily see it as a problem.

As the price continues to increase it will take less ounces to store your wealth as we move forward through a crisis period. Transporting gold will only become easier and easier as we move forward.

The below website gives very clear infographics depicting the size of varying amounts of gold. For 99.99% of us, transporting our gold savings won’t be difficult.

Infographic Depicting Various Gold Amounts

In the above picture, you can see how much gold your truck can carry before the suspension gives. I doubt anyone reading this article will be moving over 100 million dollars worth of gold. I think we will be just fine transporting our gold stack.

Important tip: Never tell anyone about your commodities. In desperate times, people, even people you trust, will take desperate measures to protect themselves and the people they love. This leaves you at risk of being robbed. I will probably write an article in the future regarding safe ways to store your precious metals, but for now, what people don’t know they can’t take. Abide by this rule.

This leaves the only possible problematic outcome, which is in the event we have another gold confiscation. Could it happen? Well, it happened before, and history often repeats itself or at the very least rhymes.

My answer to this is probably not going to be popular and that is to wave your middle finger at their confiscation. Don’t turn it in. Do not give them your wealth so they can steal 41 cents on the dollar like they did last time.

But won’t my gold be worthless?!

Of course not. I believe you, along with many others will continue to use it outside of the dictated system the government forces us into. A barter system. Precious metals allow for a parallel system we can participate in.

The one negative to this is the price of gold will become a less useful tool on a daily basis the higher the price goes.

One ounce of gold today at nearly $2,000 is not something that can be divided, therefore, you aren’t buying groceries with it. But a car? Sure. A handful of gold bullion could purchase you a nice used car in a peer to peer transaction that stays off the grid.

My goal is to always have enough gold to give me two years of protection in a time of crisis. No income? No problem. This amount is different for everyone but you can figure out your number by calculating your monthly expenses by 24 months to find out how many ounces you will need to hold in order to live off it.

Silver

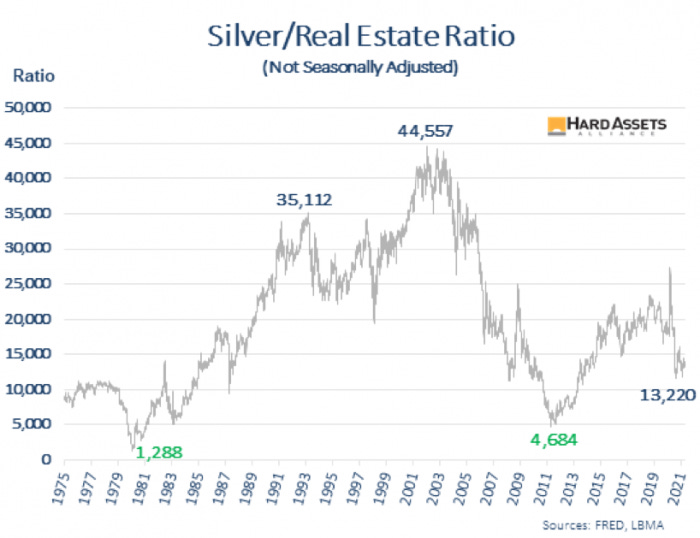

Another necessary commodity but serves a different purpose than gold. I don’t see silver as a store of wealth, although it has some of those qualities.

Silver may not be known as a the store of wealth gold is, but, as you can see, it has been a safe haven against the dollar during times of crisis as well.

But I see an even bigger reason for silver to be in your portfolio.

We discussed in the gold section, that gold isn’t the best for day to day transactions because of its value. Silver, on the other hand, is a fantastic way for everyday purchasing on a parallel system. Its value allows for the opportunity of a realistic peer to peer payment system in many purchase situations.

The real key is creating a community of trading precious metals. I suggest to start building those relationships now, create the infrastructure in your community now so you are prepared when problems arise.

Bitcoin

This is a topic worth many articles, let alone one section within one part of an article, but first, let me tell you a story.

It was the Fall of 2017 and I was at a family dinner. My cousin brought up bitcoin. He didn’t understand why the price was going up so dramatically. I told him that it will continue to rise higher and higher and here is how that conversation went:

Him: I don’t understand why it has any value. It is backed by nothing, what is it, some invisible magic coin? It doesn’t make sense.

Me: What is your fiat money backed by?

Him: If I try to pay for my dinner tonight with dollars they will take it. They won’t take bitcoin.

Me: They won’t take my gold either and your precious dollar has lost 96% of its value in the last century, whereas my gold has held its value. It isn’t about whether the restaurant will accept it, it is about its traits that allow it to be a store of value and retain wealth.

Him: And how does it act like a store of value?

Me: It is written into the code. There is a finite supply of bitcoin. There will only ever be 21 million (I didn’t go into the fact that due to lost wallets and other factors, that number is actually lower). While your fiat currency will print more into the supply forever, until it's inevitable demise, my bitcoin will continue to rise in value.

The price was around $3000 a bitcoin at the time.

Him: I just don’t get it. You can’t hold it or see it. How do people trust this?

Me: It is digital gold. It is volatile and will continue to be until it matures, but at the end of the day it will simply be an easily transportable gold. We can send our store of value to anyone with a bitcoin address and that is powerful. I will say today that it is the most powerful technology in our lifetime.

Him: I don’t see it, but whatever.

I own bitcoin and will continue to stack because of its ability to increase dramatically in price and hedge against the dollar. I also see it as having value in a parallel system but only after bitcoin has matured and become less volatile.

Bitcoin is the largest portion of my portfolio, followed by gold, then silver.

Other than stores of wealth, is there anything else I can do?

Absolutely. We already touched on building community infrastructure. It is important to get to know like-minded individuals valuing liberty, freedom, and an alternative plan from extreme state measures.

Just as important as community infrastructure is fighting these policies head on. Do not be shy about what is going on in the world, where that is headed, and your solutions and thoughts on it. We need these messages to spread. We need an awakening more so now than ever in our lifetime.

If you enjoy this content and don’t want to miss out on future articles, please make sure to click the subscribe button for more free content.

Make sure to follow NoNationNews on X